Business Customer? Try business the Brite way today.

The briter

way to pay*

and get paid

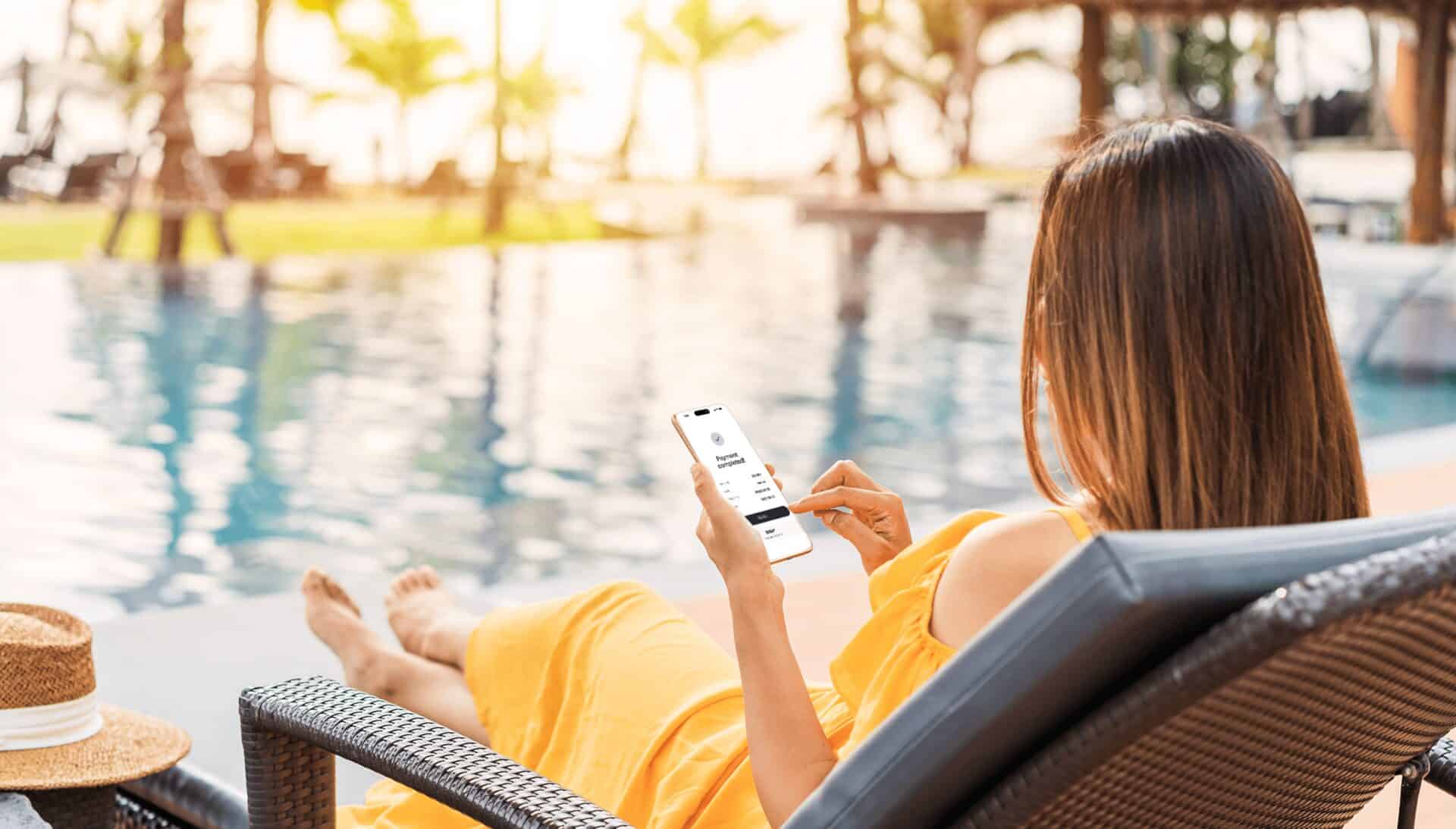

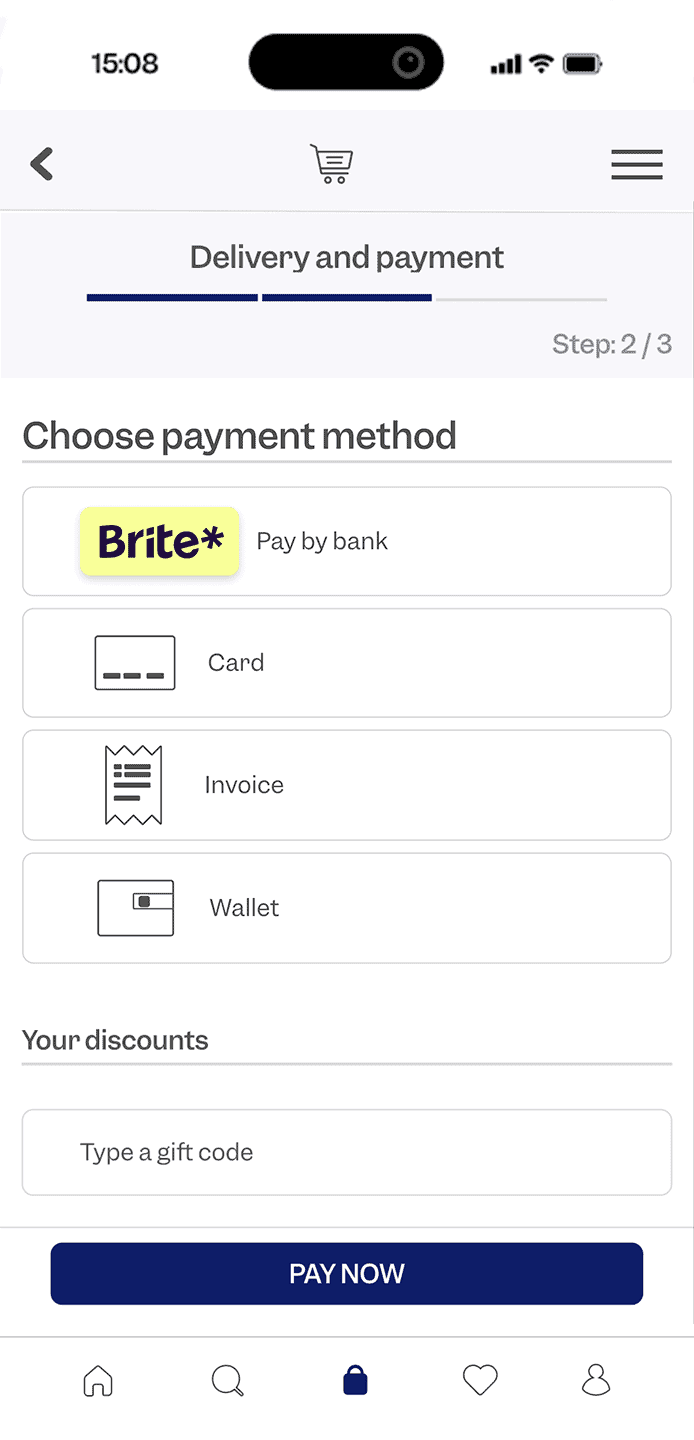

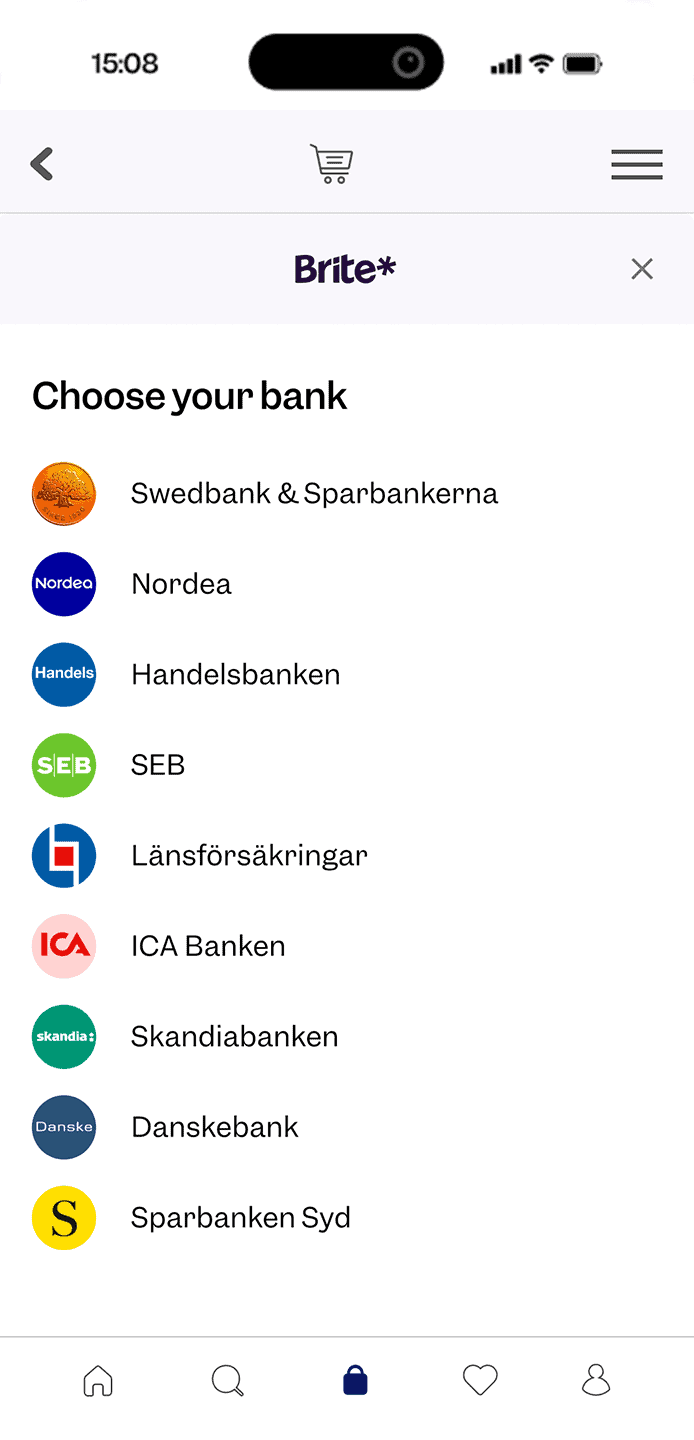

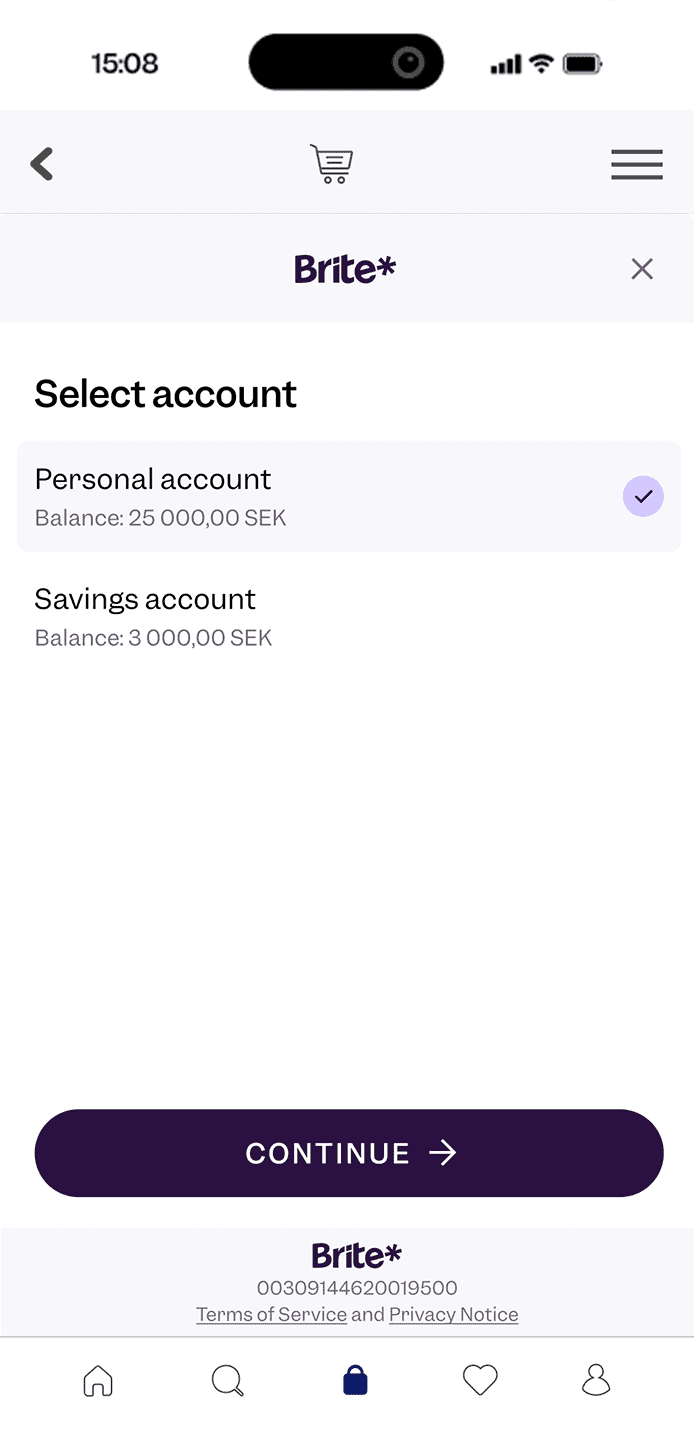

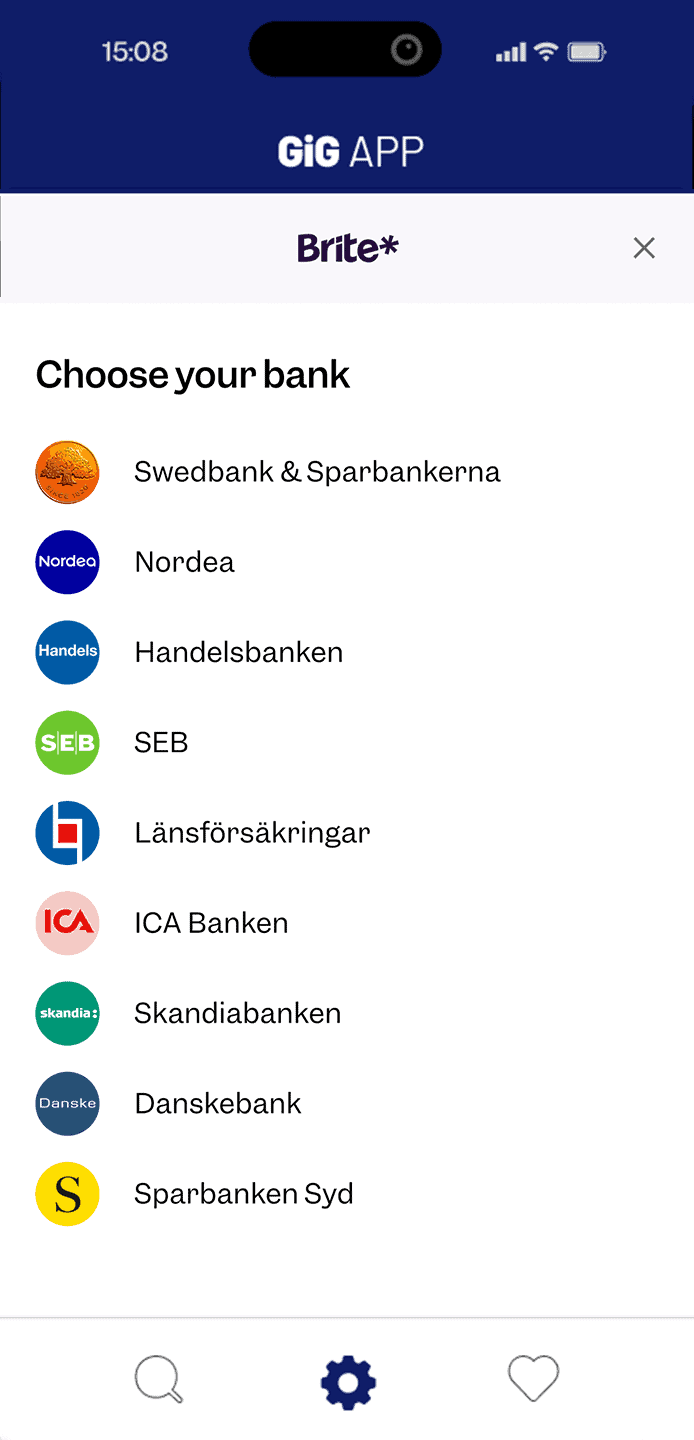

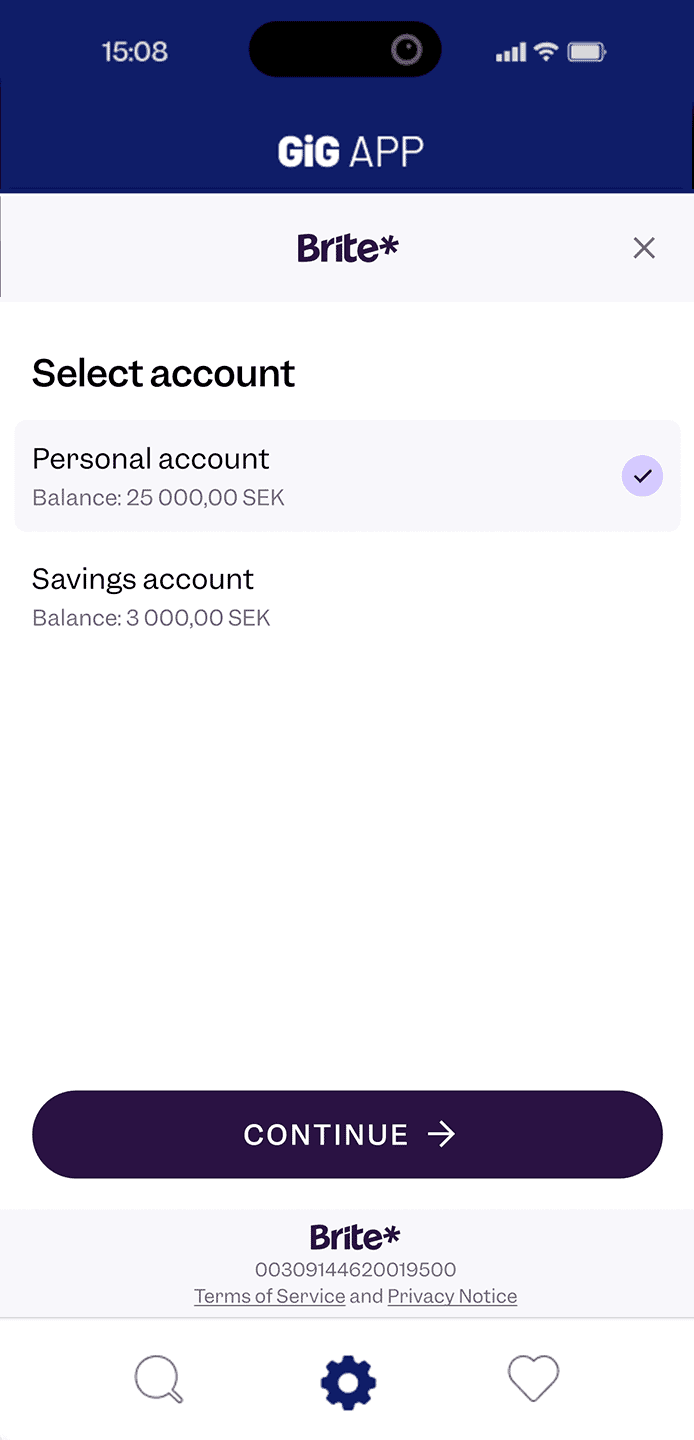

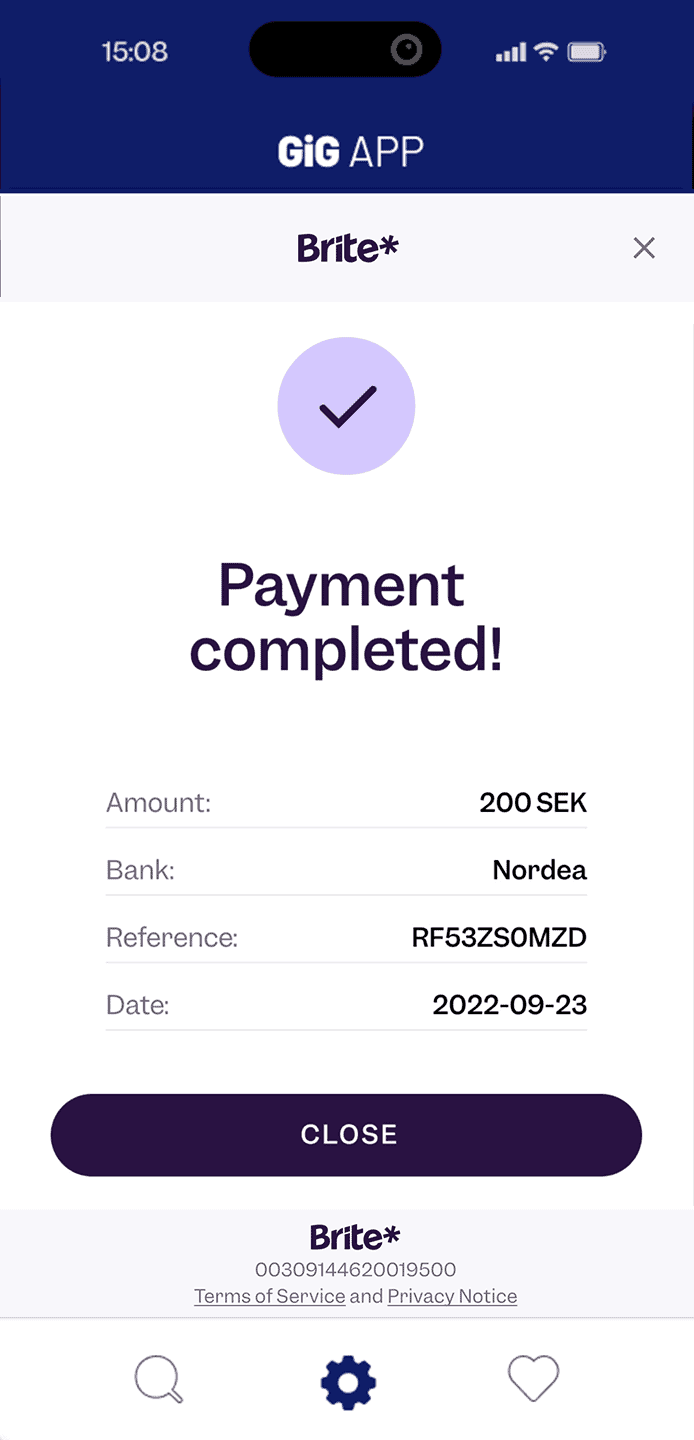

Introducing faster, smarter, more secure payments. No cards, apps or sign-ups. Just choose your bank account and pay. It’s that easy.

What we do

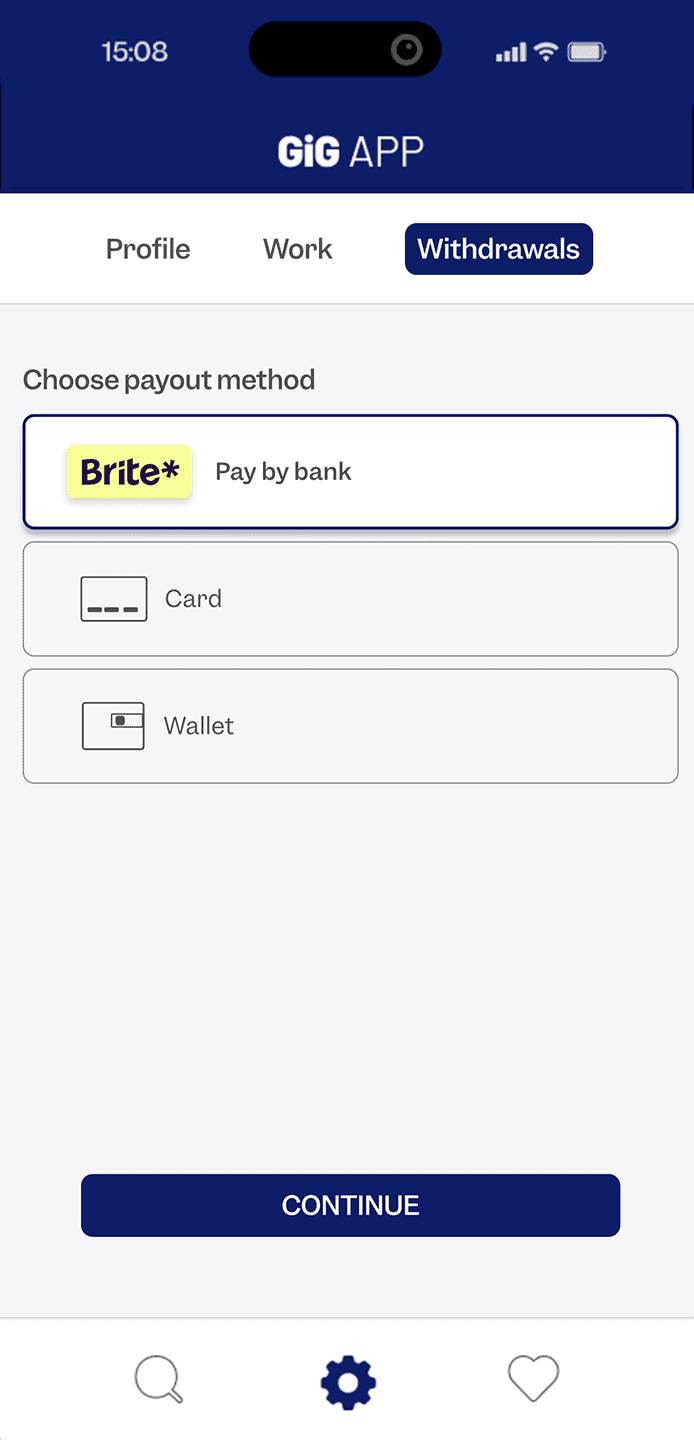

Seamless payments and super-fast payouts

Faster, smarter, more secure. Brite takes care of transactions from customer to merchant, and back again. No sign-ups, no card details and zero hassle.

Why Brite?

The briter way to pay and get paid

Introducing fully transparent, faster, smarter, and more secure payments. Powered by open banking.

Refreshingly simple

Use your bank authorisation to pay direct from your bank account. No card details, no downloads and no problem.

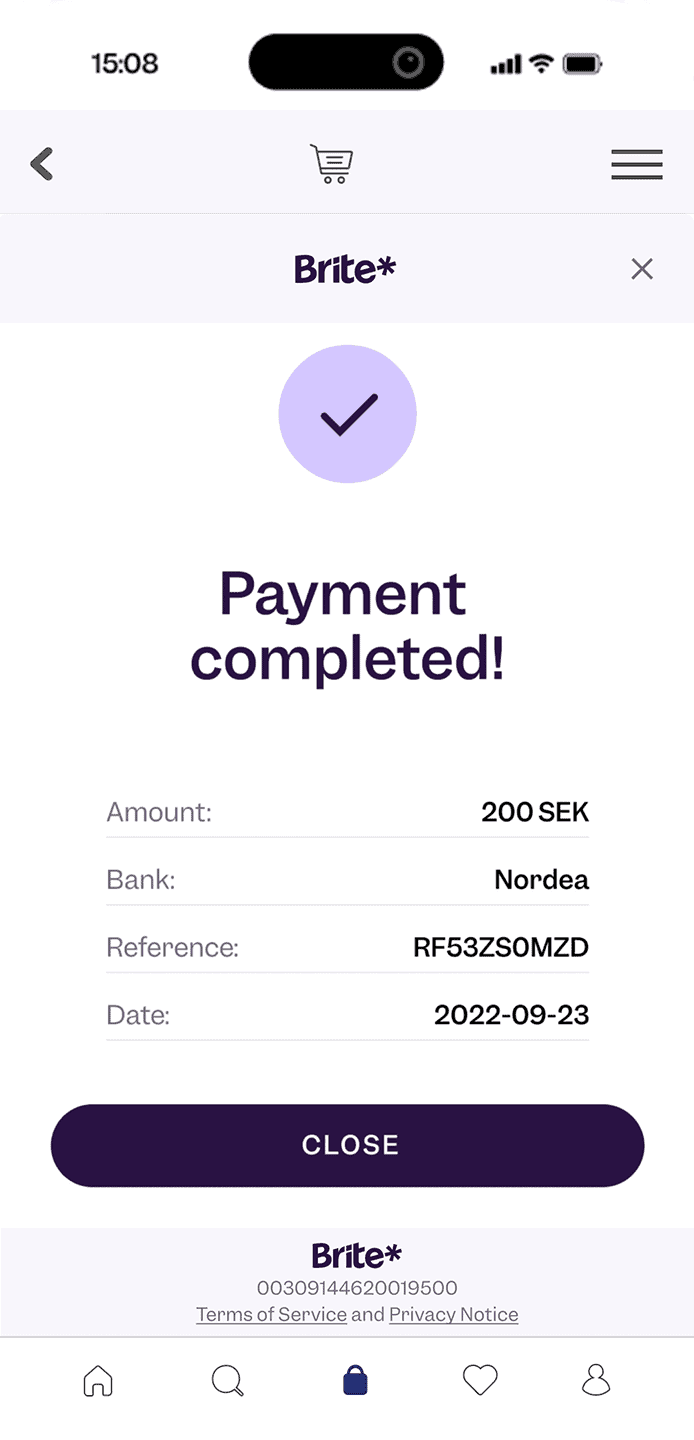

Lightning fast

Experience payments at Brite speed with our Instant Payment Network between your bank and any business.

As safe as it gets

From start to finish, Brite protects funds using the highest encryption standard available.

Need help with a payment?

Local experts. Global reach.

Europe’s looking brite

We operate all over Europe. Providing Instant Payments 24/7, 365 days a year.

Our global reach

The Brite network in numbers

Connecting forward-thinking merchants and customers since 2019.